August 23, 2022

Our church is making money (or thinking about it). What about taxes?

Don’t let confusion about taxes stop you from doing something new, say two experts in faith-based social enterprise.

More and more churches are looking at new ways to generate revenue beyond the offering plate. This might take the form of renting rooms in a church building to a community partner, starting a new social enterprise like a grocery co-op, building affordable housing — anything that generates earned income.

There is a lot of promise in these activities, and through them many churches may not only generate revenue but also engage in new and meaningful expressions of ministry that serve vital needs in their communities.

But making money from earned revenue activities raises new questions and concerns about something most churches have largely ignored: taxes.

Does a church renting out rooms need to pay income tax or property tax? Does a church selling coffee need to charge sales tax? Is a church’s new development project subject to property tax? And could too much “business activity” jeopardize a church’s tax-exempt status?

We have experience with church-based social enterprise and taxation from both the academic and the practitioner side. Andrew McGannon recently wrote a thesis on tax implications for faith-based social enterprise in the U.S., and Mark Elsdon is the executive director of Pres House, a $2.4 million-per-year faith-based social enterprise, and consults with churches throughout the country on revenue generation and social entrepreneurship.

While this article cannot answer tax questions for any specific situation, we offer the following suggestions to keep in mind for churches generating new revenue.

Do we need to worry about paying taxes?

Yes and no. Ironically, perhaps, the two broad risks related to taxation are to not worry about taxes enough … and to worry about taxes too much.

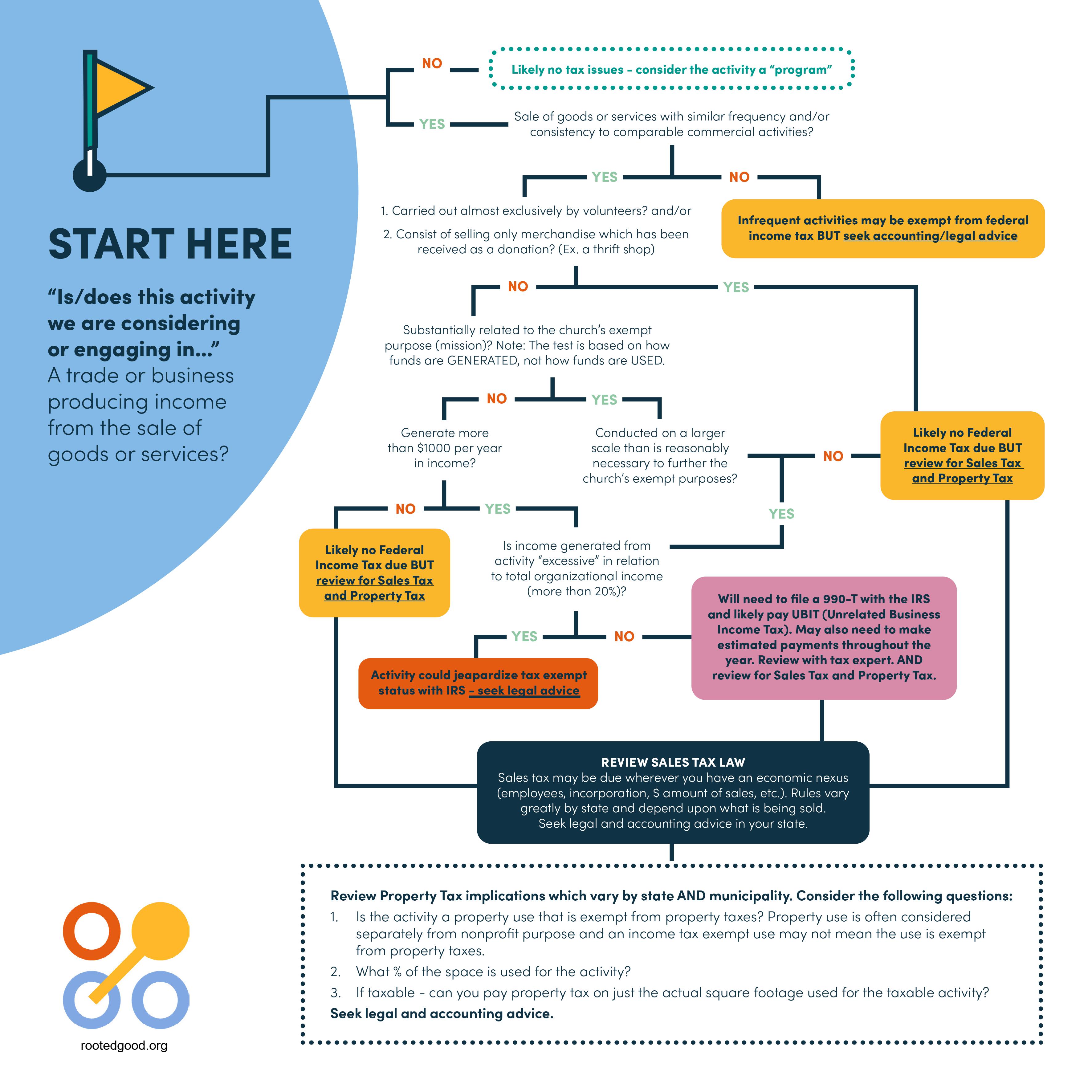

Generating revenue can, and often does, trigger some taxation, through unrelated business income (UBI) tax at the federal level, sales tax at the state level and/or property tax at the local level (see decision tree below).

Churches generating revenue from income-producing activity should not ignore taxes. It is our legal and ethical responsibility to understand and comply with applicable tax law.

On the other hand, worry about taxation and fear of trying anything new can stifle innovation in congregations. Taxation should not prevent a congregation from creating innovative ministries using a social enterprise. Most concerns can be addressed through careful decision making. And paying some taxes on a socially and financially valuable enterprise isn’t the end of the world.

Is our tax-exempt status at risk?

Earning revenue through a social enterprise may incur taxes, but it is unlikely to result in a loss of tax exemption given proper planning and consideration.

Some key considerations in determining whether a new activity fits within an existing nonprofit exemption include the scale of the social enterprise as well as the relevance to the core mission of the organization as expressed in its mission statement.

If revenue from the social enterprise becomes significant relative to the rest of the income of the church, especially if the social enterprise is not specifically relevant to the mission of the organization, changes to the legal structure may be necessary.

Churches can often benefit from creating an affiliated limited liability company or an entirely separate nonprofit organization to house a social enterprise and its revenue. Proper planning and consideration around the financial and legal implications for a social enterprise, with assistance from tax experts, will likely prevent any risk of loss of the tax-exempt status.

Again, don’t let fear of losing your tax-exempt status stop you from innovating.

So what has been done? Two examples.

Affordable housing

St. Paul’s Commons is a mixed-use affordable housing apartment complex located in Walnut Creek, California. Building upon a long legacy of ministry around housing insecurity, St. Paul’s Episcopal Church is providing, with this enterprise, 44 units for individuals who were formerly experiencing homelessness.

They also rent space to other nonprofits that engage in case management, employment services and related programs. The St. Paul’s Commons space opened in March 2020, just as COVID lockdowns were beginning. One of the leaders recalled that moment, saying, “It’s ironic: just as the world was shutting down, I was handing out keys to people’s homes.”

St. Paul’s Episcopal Church owns the land on which the complex sits, but the new building is owned by Resources for Community Development, a nonprofit focused on developing affordable housing.

Through careful legal structuring and accounting, St. Paul’s Episcopal Church has developed a way to serve their community with a tangible and much-needed service without jeopardizing their tax-exempt status or becoming overly burdened by tax liability.

Coffee shop

Coffee shops have been a popular option for churches interested in offering alternative programming and generating additional revenue. Union Coffee Dallas is an experimental model that advances a hybrid social enterprise and worship space.

Rather than a coffee shop within a worship space, Union is a worship space within a coffee shop. They aim to cultivate a nontraditional worship space for individuals who are looking to develop their spiritual faith but do not necessarily identify with the mainline traditions.

By regularly donating a percentage of revenue to other nonprofit organizations, Union lives out their tagline: “The Most Generous Cup of Coffee in Dallas.” They hold worship events, writing workshops and narrative storytelling performances in the space.

Union was started in 2012 as a ministry of University Park United Methodist Church. In fall 2021, they officially chartered with the North Texas Conference as a missional congregation. The property and building where Union is housed is owned by Oak Lawn United Methodist Church.

Union Coffee House Ministry brings in three different types of revenue: traditional coffee shop income (coffee shop goods, merchandise and room reservations), donations and fundraising events, and foundation grants for specific projects.

With help from an accounting firm that specializes in nonprofit accounting, they are able to keep track of the different streams of revenue and the tax implications of each. They also pay property taxes per the applicable Dallas property tax code. Union is exploring how to expand to different locations and may create an additional limited liability company to provide the flexibility needed for expansion.

Where can I find additional resources?

Our organization RootedGood has facilitated the production of a number of resources, including a training video with experts on church taxes and a more comprehensive decision tree tool that assists congregational leaders in navigating the complexities of social enterprises and income-generating activities.

These resources begin to address some of the major questions that congregational leaders have around the topic of taxation and revenue generation. Congregational leaders are also encouraged to reach out to legal and accounting expertise in their local contexts to answer questions and set up structures well. Problems can often be avoided by some up-front investment in expert assistance.

The information contained in this piece is provided for informational purposes only and should not be construed as legal advice on any subject matter. You should not act, or refrain from acting, on the basis of any content included in this piece without seeking legal or other professional advice.

Some content for this article is drawn from a thesis researched and written by Andrew McGannon for RootedGood, which includes additional case studies and the broader legal context around revenue generation and taxation within congregations. Used with permission.

Share